Most group risk providers are reluctant to write schemes for fewer than 5 members, and then only as part of a registered group risk scheme.

Our approach is different. The relevant life policy is a single life, stand-alone death-in-service plan, providing benefits on an individual basis.

Key benefits :

– Unique individual stand-alone cover

– Tax advantages for high earners

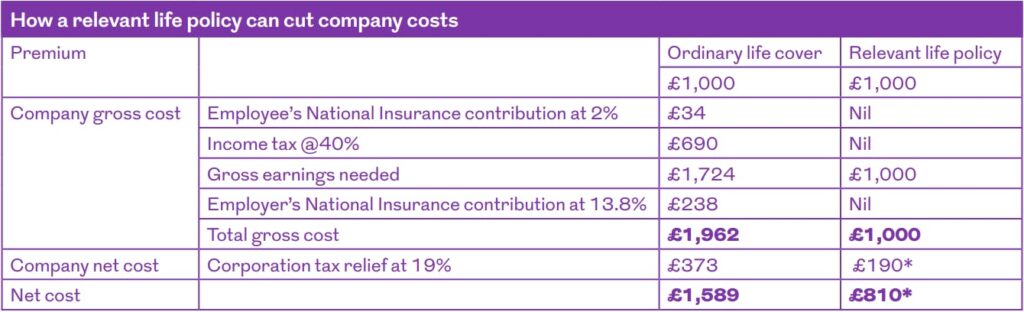

– Premiums not taxed as a benefit in kind

– Allowable as an expense for the employer

– Cover now up to 20 times annual salary

There are various advantages to this. For a start, it offers high-earning employees who have substantial pension funds a number of tax advantages.

That’s because the lump sum benefits do not form part of the employee’s annual or lifetime pension allowance.

And, although the company pays the premiums, they are not normally taxed as a benefit in kind – which can offer huge savings, especially for a higher rate taxpayer.

For more information, please contact Anthony Marshall on 07872 898900 or email at: anthony@marshallfinancialsolutions.co.uk

Alternatively, speak to Mark Rabe from BBX on 01202 836060 | 0333 400 2014 or email: mark.rabe@bbxworld.com