Could you be eligible for a large payout?

You can claim SME R&D relief if you’re a SME with:

less than 500 staff

a turnover of under €100m or a balance sheet total under €86m

You may need to include linked companies and partnerships when you work out if you’re a SME.

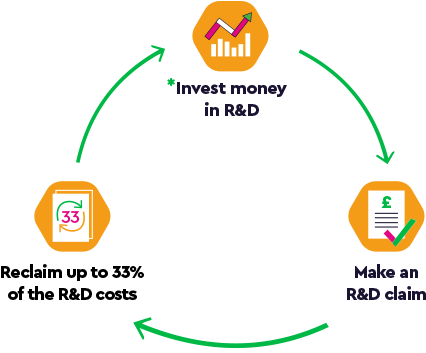

SME R&D relief allows companies to:

deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction

claim a tax credit if the company is loss making, worth up to 14.5% of the surrenderable loss

Get a free no obligation consultation now.

No commission payment just a one of fee of BBX£1950*